Negotiating Value-Based Reimbursement Agreements with Commercial Insurers

Insurance companies have been pursuing value-based reimbursement agreements with primary care physicians and numerous specialty practices for years. Unfortunately, despite their loud proclamations to the contrary, few insurers have been willing to negotiate these types of agreements with centers that have hard data showing how effectively their treatment helps patients recover from addiction.

Insurers have a very bottom-line focus and, for at least the time being, centers who want to negotiate higher reimbursement rates or be invited to become preferred providers should probably plan to negotiate on the basis of how much their treatment reduces their patients’ need for future Emergency Department visits, unplanned hospital stays, and additional SUD treatment episodes. An ongoing challenge with this, of course, is that the insurance company is going to base their decision on their own claims data, which they may or may not share with the center.

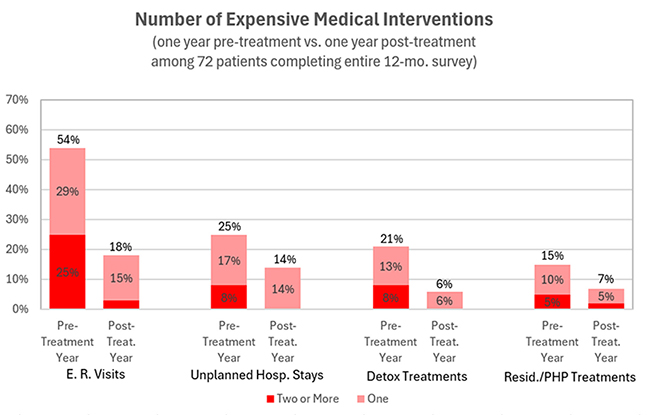

Vista’s outcomes research aims to partially level this playing field by using patient self-reported data to estimate what the insurer’s claims data shows. Vista’s annual reports compare the number of expensive medical interventions in the pre-treatment and post-treatment years for patients who responded to Vista’s outcomes survey requests:

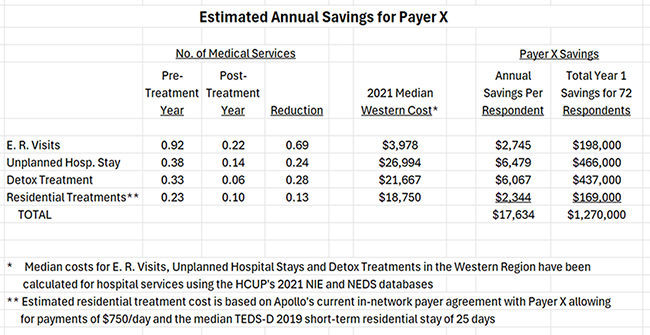

In fact, in Vista's Payer Summary report, Vista takes this one step further and uses recent cost estimates for SUD-related medical interventions in the center’s region to estimate savings per member for the post-treatment year in total hospital-based medical spending. Based on patient reports, it looks like Payer X saved $17,634 per member in medical spending during the post-treatment year as a result of their treatment at this center!

The Payer Summary Report

To help our clients with their negotiations with health insurance companies, Vista produces special Payer Summary reports that analyze the outcomes for members of a specific payer. This report summarizes the metrics payers consider most important, including the estimated savings per member as calculated above. It also includes improvements in co-occurring disorders over time, HEDIS measures, and patient improvements in social determinants of health resulting from treatment. You can download a sample Payer Summary Report by clicking on the report image:

And the best part? Because we know how important it is for our clients to be able to negotiate higher reimbursement rates, Vista supplies each client with up to three Payer Summary Reports per year for free!

Negotiating with Self-Insured Employers

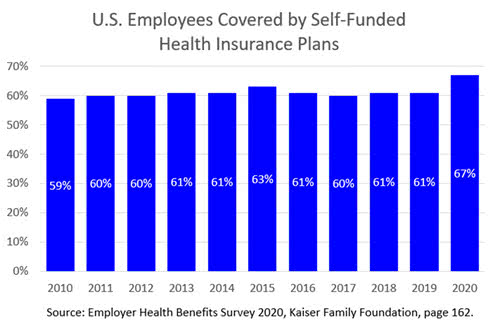

At least in the short term, employers who are directly paying some or all of their employees’ health care costs are likely to be more receptive than commercial insurers to negotiating preferred agreements with treatment facilities on the basis of post-treatment abstinence. Fortunately, this market is large and grew substantially in 2020: