Stricter Licensing Requirements

One discernable trend reflects growing strictness in state laws and regulations across the country relating to addiction treatment program licensing. In 2018, for example, California passed laws expanding DHCS power to revoke or discipline facility licenses. The State adopted significant new operational limitations in AB 3162, limiting off-site provision of services and requiring programs to submit written relapse plans to the state. The new law establishes a shorter provisional licensure period for new facilities, during which licenses may be revoked by DHCS for a wide variety of reasons, including repeat deficiencies, mishandling of medication, and failure to adhere to facility policies and procedures.

Similarly, Florida made significant changes, including issuing separate licenses for each service component offered by a provider, requiring providers to admit at least one patient for services during a probationary license period in order to have a regular license issued, and limiting licenses to expiration after twelve months. Florida also adopted a stringent limitation on changes of ownership, providing that transfer of even 1% of ownership will now trigger “change in ownership” approval requirements and the need for a facility license from DCF.

Across the country, the observable trend has been states ratcheting up their oversight authority and power to discipline and revoke addiction treatment program licenses, as well as imposing new operational constraints. Addiction treatment programs should pay close attention to changing laws in their states, and prepare for this trend to continue as states further identify operational risks and tighten addiction treatment facility standards.

Regulating or Rolling Back Sober Living?

The issue of recovery housing oversight continues to be a hot topic for legislators and regulators in 2021. While recovery housing has historically been unlicensed in reliance on the statutory FHA and ADA protection, a number of States have begun to regulate homes in response to concerns over the proliferation of homes, neighbor complaints, and possible involvement in patient brokering. Several states (including Florida, Maryland, Massachusetts, Missouri, Rhode Island, Pennsylvania, and Illinois) have embraced a model pioneered by the National Association of Recovery Residences (NARR) for voluntary certification of residences. In the case of Florida, the certification is voluntary, but uncertified facilities may not have referral relationships with licensed treatment providers. Other states have limited uncertified facilities from receiving state funding or referrals from state agencies.

Three states (New Jersey, Utah, and Arizona) have gone further and imposed licensing requirements, a shift from the traditional FHA and ADA understanding. In other states, the activity has not been at the state level, but instead regulatory changes and increased enforcement at the local level, including the use of nuisance lawsuits against recovery homes. 2021 is likely to continue to be a year of some tension between state efforts to regulate and local efforts to roll back recovery housing.

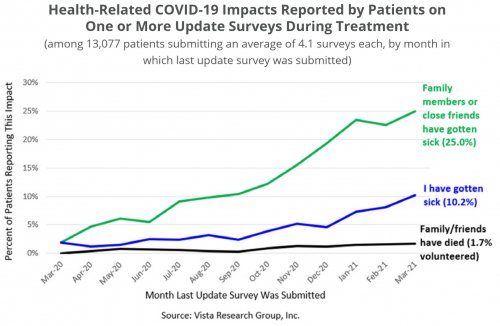

Expanded Coverage for Medicaid Beneficiaries

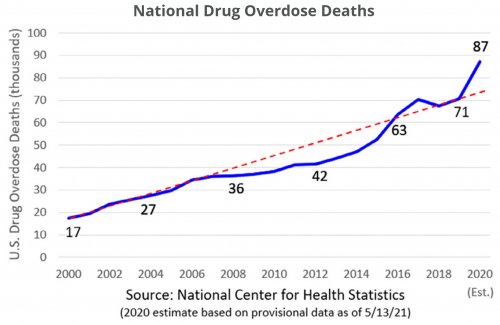

Another pronounced trend has been the expansion of coverage of a growing range of addiction treatment services for Medicaid beneficiaries. With demand for access to care rising from the population of Medicaid beneficiaries, providers are likely to see continuing opportunities to expand coverage to fill the void in a broader continuum of SUD/OUD services.